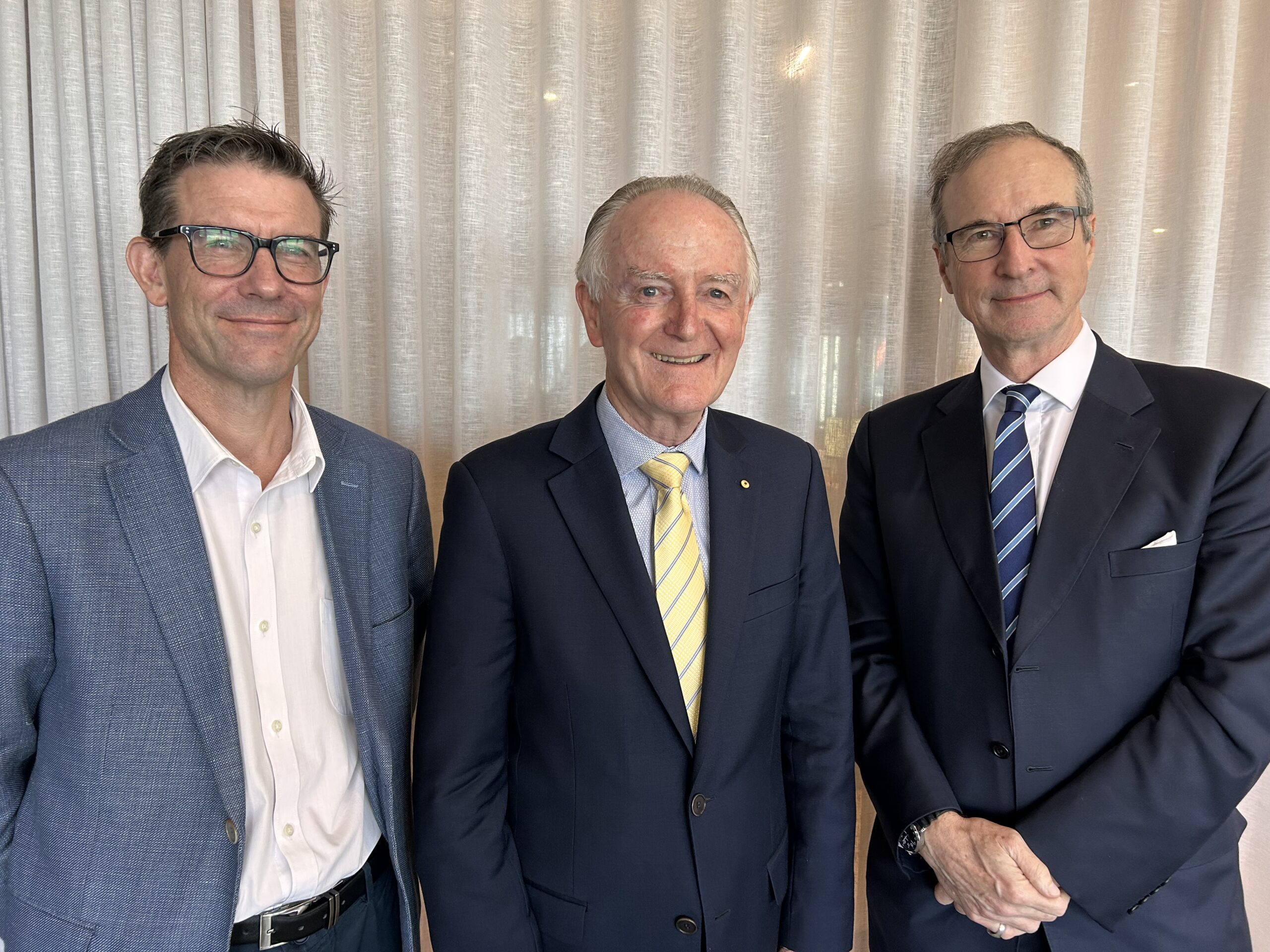

HOPE Housing is delighted to announce that respected industry leader Michael Dwyer AM has been appointed as our inaugural Chairperson, marking a significant milestone in HOPE’s journey and a step forward as we prepare to scale.

Michael’s appointment comes at a pivotal time for HOPE. With a growing track record, strong financial and social returns, and more than 3,000 essential workers on our waitlist, the foundations are in place for rapid expansion. The formalisation of Michael’s role will provide dedicated strategic leadership as we grow.

Michael has been with HOPE since the very beginning, volunteering his time and expertise since 2018. Over the years, he has offered valued counsel to our founders, Tim Buskens and Tim Sims, and played a key role in shaping our governance and long-term strategy.

With over 30 years of experience in financial services, Michael’s leadership credentials are extensive. He served as CEO of First State Super from 2004 to 2018 and currently chairs NSW Treasury Corporation (TCorp) and the MSquared Capital Advisory Committee. He is also a Director of ASX-listed Iress and holds advisory positions with the ASIC Consultative Panel and the Global Advisory Council for Tobacco Free Portfolios. In 2011, he was appointed a Member of the Order of Australia for his significant contribution to the finance industry and community.

Reflecting on the worsening housing crisis, Michael said:

“When I started with HOPE back in 2018, Sydney’s median house price was $1 million. Today, it’s $1.69 million. Housing affordability continues to deteriorate, especially for essential workers who aren’t on high incomes. They are crying out for solutions. HOPE has stepped up, demonstrated its effectiveness, and is now positioned to deliver a real difference.”

HOPE was created to meet this very challenge, helping essential workers buy homes in the communities they serve. Since launching, HOPE has helped 35 essential workers become homeowners across 24 properties in Greater Sydney. Our shared equity model is designed to create both a social and financial return. In 2024 our fully calibrated social return stands at 14.4%.

Tim Sims, co-founder of Pacific Equity Partners and HOPE Housing, said:

“Michael’s formal appointment is strategically significant. His deep expertise and respected leadership strengthen HOPE’s governance, positioning us to deliver even stronger outcomes—both in creating pathways to home ownership for essential workers and in achieving attractive, sustainable returns for investors.”

HOPE CEO Tim Buskens added:

“Achieving real impact alongside strong commercial returns isn’t easy, but HOPE is proving it can be done. Michael has been a critical part of our journey from the start, helping to shape the foundations. I’m honoured to have his continued support as Chair as we enter our next phase.”

With the systems, processes, and team now in place, HOPE is operationally equipped to support up to 20 new shared equity home purchases every week – ready to deploy $300 million in the next 12 months and meet the growing demand from essential workers across Greater Sydney.

Quotes are views of third parties only and may not reflect the performance of the Funds nor reflect the opinions of SILC or its affiliates.

HOPE Funds are available to wholesale investors only. Prospective investors should carefully review disclosure documents for HOPE Funds in full and seek professional advice prior to making any investment decision. For more information about the Funds, please refer to the Investor Disclaimer on our website.

Social return on investment is assessed by surveying homeowners and applying financial proxies to calculate value creation using a methodology that adheres to Social Value International’s principles of social valuation. ‘The Principles of Social Value’ and the methodology is available on Social Value International’s website.