Enjoy the returns of residential property without the stress of being a landlord

AS SEEN ON

Certified Sustainable Plus by RIAA

This recognition underscores our commitment to responsible investment, rigorous stewardship, and transparency. HOPE’s approach delivers financial strength with a social focus, driving real, lasting impact.

Why residential real estate?

Strong(ii), long term returns

Access a diversified portfolio of vetted Australian residential real estate assets, offering strong returns, supported by Sydney’s consistent 9.2% p.a. average growth over the past 50 years^.

Resilient to economic shocks

Residential real estate has performed well through all crises in Australia including GFC and COVID*

Significant portfolio diversification benefits

Low correlation to other asset classes which improves investment portfolio performance#

Why invest?

Strong returns(ii)

Access a property growth linked return from a diversified portfolio of vetted Australian residential real estate assets.

Reduced outgoings(iii)

Enjoy the growth upside without the usual land-tax, letting fees, maintenance, and mortgage costs.

Socially responsible

More than property growth, you’re investing in essential workers, so they can own a home close to work.

Hear from our investors(iv)

How it works

The HOPE Fund gives investors a new way to access the stable and solid returns of the Australian residential property market, while enabling home ownership.

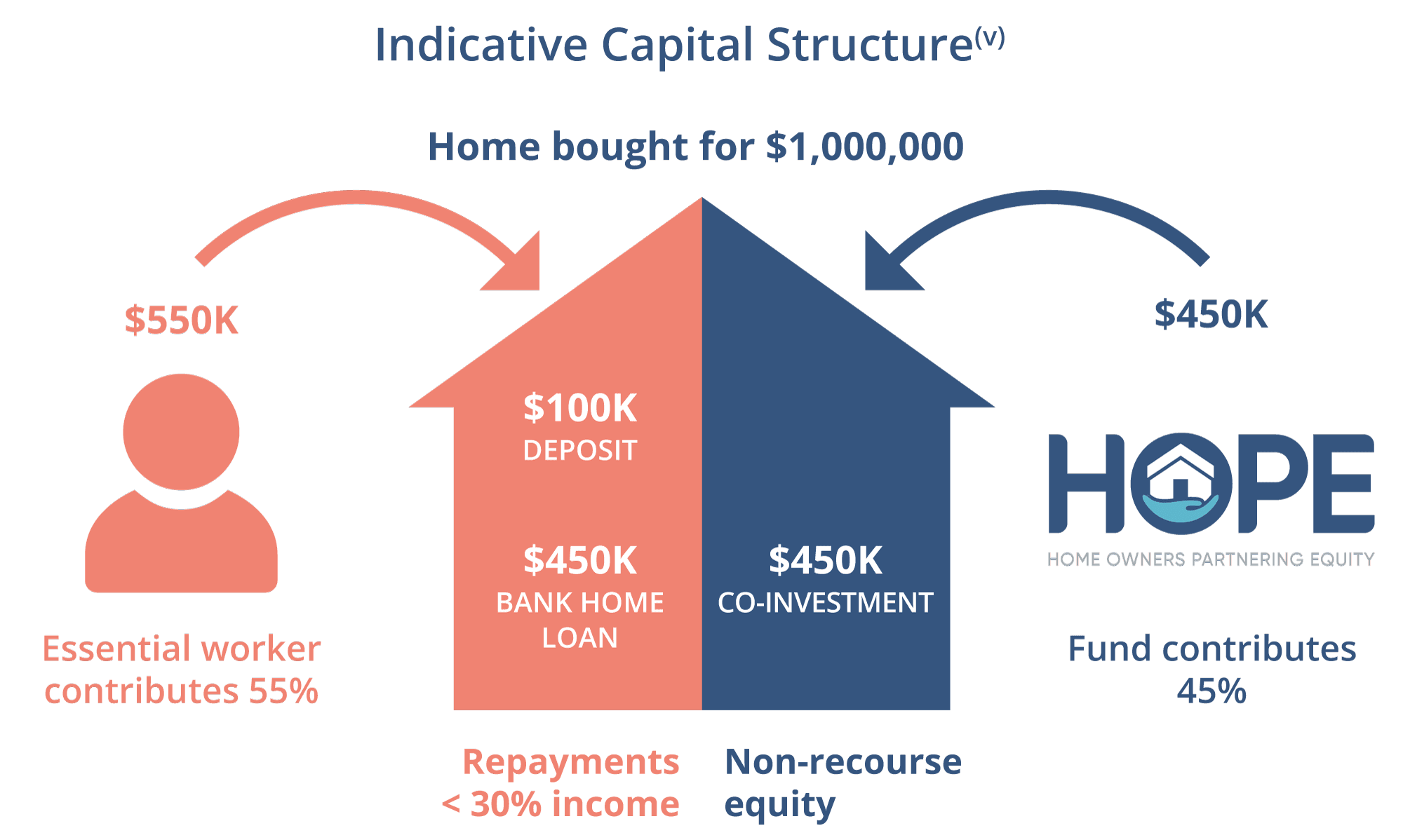

We achieve this through our unique shared equity model, which puts home ownership within reach of our dedicated essential workforce community and simplifies and de-risks property investment for investors.

Benefits of investing

No upfront and ongoing property investment expenses

This investment does not incur stamp duty, rates, strata and maintenance costs for the investor.

Vetted properties and homeowners

The Fund sets tight parameters on assets and homeowner selection to meet return targets.

Hassle free

No tenancy management responsibilities – our homes are owner occupied.

Scaled access to residential property

Unitised exposure allows investment in the Fund’s diverse property portfolio, rather than being tied to a single property, as may be the case through a direct investment.

Benefits for homeowners

Low deposit

Homeowners can enter the scheme with a minimum of 2.5% contribution towards the property price.

Manageable mortgage

HOPE and Police Bank ensure mortgage servicing is within 30% of household income when essential workers enter the scheme.

Close to work

Homes are located within 30 minutes commute of an essential worker’s workplace, reducing commute times and stabilising workforces in critical urban regions.

Meet our team

Tim Buskens

Chief Executive Officer

Jennifer Vercoe

Chief Financial Officer

Debra Goundrey

Head of Investor Engagement

Allyson Bailie

Head of Operations & Marketing

Evan Hinchliffe

Head of Distribution

Ravipa Rojasavachai

Quantitative Analyst

Tim Mifsud

Head of Digital Experience

Learn more in our Investor Centre

Demonstrating Liquidity: Homeowners Actively Buying Out HOPE’s Share

A Proven Model, Poised for Scale

CEO Update – July 2025

Supporters of HOPE

Our judges were impressed by the simplicity and effectiveness of this approach, noting that it “creates both security of home ownership and an institutional investment opportunity.”

SHARED VALUE PROJECT

“I look at what HOPE Housing are doing and I think it’s a great idea. We need more HOPE Housing.”

MICHELLE LEVY

I am a potential investor, keep me updated!

Subscribe to our Investor Newsletter ‘Insights from the Frontline’ using the form below

How to invest

-

Confirm you meet the sophisticated investor test.

To be a sophisticated investor in Australia, you must meet one of the following requirements:

- Have net assets of more than A$2,500,000

- Have income of at least A$250,000 per annum over the last two financial years

- Able and willing to invest $500,000 or more into this opportunity

-

Review Fund Disclosure documents.

-

Complete an online application to apply for units in the Fund.

Investors apply online for units in the fund.

Funds are only deployed into assets that are:

- Vetted by HOPE’s investment committee, with purchase caps set.

- Owned and occupied by essential workers who have been vetted by Police Bank, for the purposes of acquiring and servicing a mortgage on their 50-70% share in the property.

Homeowners progressively purchase additional equity in the property at the prevailing market rate, stepping into full ownership over time. They can use a combination of savings (or the like) and mortgage top-ups in order to facilitate equity buybacks.

Equity buybacks or full sale events generate cash distributions to investors.

Talk to our investment team about investing with HOPE

DEBRA GOUNDREY

Head of Investor Relations

EVAN HINCHLIFFE

Head of Distribution

Disclaimer

The offer of units in the HOPE Housing Residential Property Trust (Fund) is available only to ‘wholesale clients’ within the meaning of that term under the Corporations Act 2001 (Cth). This page does not constitute an offer for units in the Fund.

Past performance is not a reliable indicator of future performance.

Prospective investors should carefully review the Information Memorandum (IM) of HOPE Housing Residential Property Trust (Fund) in full and seek professional advice prior to making any investment decision. For more information about the Fund, please refer to the Investor Disclaimer on our website.

(i) HOPE refers to HOPE Housing Fund Management Limited.

(ii) HOPE offers an investment opportunity for sophisticated investors to access the Australian residential real estate market which has had Annualised returns at 7% over the period June 1995 – June 2025 – Cotality Home Value Index, Houses, Sydney. The HOPE Fund’s return may not correlate to the historical returns of the Australian residential real estate market.

(iii) An investment in HOPE Fund gets you access to a diversified portfolio of residential real estate. Homeowners are on title and required to maintain the home and all pay costs. HOPE has priority on all properties within the portfolio.

(iv) Quotes are views of third parties only and may not reflect the performance of the Fund nor reflect the opinions of the Trustee or their affiliates.

(v) Excludes costs like stamp duty, Lenders Mortgage Insurance and conveyancing fees, which are paid by the homeowner.

^Analysis performed on Oxford Economics data. HOPE Fund return may note be correlated to the historical returns of the Sydney residential property market.

*Analysis performed by HOPE Housing.

# Mollica, V. (2024) Impact of residential real estate on portfolio allocations: An application of AI – Property Technology CRC.