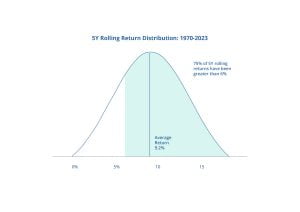

Australian residential real estate is an enticing asset class for many investors. For starters, it offers diversification from shares, bonds and other asset classes. Also, it has enjoyed historically high returns – between 1970 and 2023, the 5Y rolling return of Sydney house prices averaged 9.2% per year, according to data from BIS Oxford Economics (Figure 1), with other Australian capital cities generating similar positive gains.

Figure 1: 5Y Rolling Return on Sydney Residential Real Estate (BIS Oxford Economics)

That said, investing in residential real estate also has a number of downsides, including the potential for low yields and negative cash flow, as well as the time it takes to select a good property and then manage the asset.

There are two ways to invest in residential property: direct investing on your own or investing through a residential property fund. A fund’s strategy may be to either:

- Acquire residential properties and lease these to tenants, collecting rental income, This is similar to the direct investment model, but at scale, and managed by an investment manager.

- In this model, the return profile is typically driven by the income the assets can generate, rather than the underlying capital growth of the asset, although this can be realised if assets are sold down.

- Co-invest alongside owner-occupiers, into carefully selected properties with a selection bias towards assets that can generate better capital growth returns than assets more suited to rental i.e. houses over units

- In this model, the return profile is focused more strongly on the capital growth potential of the asset, with all maintenance costs worn by the owner-occupier the fund co-invests with.

With these two strategies in mind, let’s compare co-investment with direct investment, while also digging deeper into the pros and cons of residential real estate as an asset class.

The pros of residential property investment

- Capital growth: Historically, Australian property prices have grown over time, despite periodic corrections.

- Diversification. According to a white paper by academics Jeffrey D. Fisher and C. F. Sirmans, real estate has “low or negative correlations with stocks and bonds”.

- Less volatility: Property prices tend to be less volatile than share prices.

- Tax benefits: Finally, property investment can offer tax benefits, including negative gearing and depreciation.

The cons of residential property investment

- High entry costs, particularly when compared to shares.

- Residential property is an illiquid asset, which means selling can be a time-consuming process taking several months. Also, it can be costly: you’ll probably have to pay costs equivalent to about 3% of the sale price (principally real estate agent’s commission, marketing costs and conveyancing), and then pay tax on your capital gains.

- While it’s possible to make strong returns, these generally come over the long-term, which means you need a long investment horizon.

- By selecting a small number of property assets, risk adjusted returns are limited by the geographic concentration of the investments.

- Property prices can be volatile, which could be a risk if you were a forced seller.

Now that you understand the pros and cons of investing in residential real estate, let’s explore the two ways you can access this asset class – direct investment and co-investment and the associated pros and cons of each method.

The pros of direct property investment

- One of the biggest benefits of direct property investment is that you enjoy complete control over the investment.

- You can use equity from your owner-occupied home to kickstart the investment process, which means you can potentially become a direct investor without needing any cash savings (aside from transaction costs like stamp duty and conveyancing).

- You collect rental income, which can offset your mortgage and maintenance costs. However, it’s worth bearing in mind that 47.1% of investors are negatively geared, according to the most recent data from the Australian Taxation Office.

- Provided you can demonstrate you can service the costs of leverage (i.e. a mortgage), you can use equity in the family home or savings to build a relatively large asset base.

The cons of direct property investment

- You have to spend a lot of time researching investment locations, to find which ones have strong growth potential. Once you’ve identified your location, you have to spend even more time inspecting individual properties and analysing reports (building, pest and strata).

- Direct investors have management responsibilities. Even though most investors outsource the day-to-day work to a property manager, you still have to oversee the property manager, which can be surprisingly time-consuming and stressful. Also, appointing a property manager eats into your returns: everything you choose not to do yourself, you pay for.

- Direct investment has limited diversification appeal, given that according to data from PropTrack, 90% of residential property investor’s own two or less properties.

- There are ongoing costs in the form of property management fees, maintenance, insurance, council rates, and land tax. There are also mortgage costs, which can be particularly challenging in the kind of high-interest-rate environment we’re currently experiencing.

- As mentioned above, 47.1% of property investors generate a paper profit but a cash loss, and as such realise a cash profit, negatively geared investors would have to sell, at which point capital gains tax would apply.

- Leverage can magnify your gain when prices are going up but can also magnify your losses when prices are going down. In the December 2023 quarter, 6.5% of those who sold their property did so for less than the original purchase price, according to CoreLogic.

The pros of co-investment funds

- In the co-investment model, the fund manager invests alongside an owner-occupier. This owner is responsible for all maintenance and property-related costs (such as council rates and strata fees). Furthermore, they’re incentivised to take care of the property like an owner rather than a tenant, because they benefit from capital growth.

- Provided the fund manager is utilising an investment strategy that curates a diverse portfolio of residential properties, investors who buy units in a fund that specialise in co-investment spread their risk across a portfolio of residential assets, similar to an ETF.

- A co-investment fund may or may not use leverage to enhance returns. If they do, they may have access to lower ‘wholesale’ interest rates than direct investors.. This means an investor may be able to access a levered return in a property fund for less than going direct.

The cons of co-investment funds

- Co-investors are not in complete control of the asset or the investment process. (That said, they’re able to outsource asset selection to professionals who would be more experienced and would be able to draw on better research data.)

- When you co-invest through a fund, you have to do so with cash (not equity in your home or other property assets).

- Investors will receive cash distributions when properties in the fund sell, or owner-occupiers increase their equity stake. This cash flow can be lumpier than income from direct property investment.

Co-investment vs direct investment: a summary

Direct investment provides the investor with complete control, a steady rental income stream and the ability to invest with equity rather than cash. That said, direct investment offers less diversification than the investor might initially realise and forces them to take on management responsibilities or pay additional costs to outsource this. And let’s not forget about annual maintenance and upkeep, or costs to ready the asset for sale. Tenanted assets will experience wear and tear, which is why maintenance costs are roughly equivalent to 10-20% of the annual rental income.

Co-investment gives the investor significant diversification while freeing them of the burden of property management. However, co-investors have limited control, may not receive rental income and will have to fund their investment with cash rather than equity.

As a result, direct investment might work best for someone who loves being hands-on and has time to interact with a property manager and respond to problems.

Conversely, co-investment might work best for someone who wants a passive investment and isn’t obsessed with maximising every last cent of return.

Co-investment opportunities in Australian real estate

Direct investment is a familiar, mainstream process, whether you manage the process yourself or engage a buyer’s agent to help you make a more informed choice. You also have numerous investment opportunities: you can buy a house, townhouse or apartment; target a capital city or regional location; and invest locally or interstate.

But what about co-investing?

As a co-investor, you have the same options regarding property type and location. But where this form of investing differs compared to traditional direct investing is the model.

There are three types of co-investment models you can choose from:

1. Fractional ownership

The first option is to take fractional ownership of one or more properties through a co-investing platform. This has low barriers to entry, so you need relatively little money to buy a stake in a significant number of properties and achieve diversification. However, your control is limited and you are reliant on there being a diverse enough base of investors that your investment has a level of liquidity. Fractional ownership may suit an investor who wants to choose which property they invest in, but outsource the rest of the process to another party.

2. Joint tenancy & tenants in common

The second option is to purchase one or more properties in conjunction with a relative, friend or business partner, either as a ‘joint tenancy’ or as ‘tenants in common’. This reduces the cost of going it alone, but also means you have to consult another party before making decisions.

Joint tenancy or tenants in common may suit an investor who wants to ‘split the difference’ by choosing a co-investing option that is quite similar to direct investment.

3. Through a property fund manager

Finally, you can invest in a fund that owns a portfolio of properties. This is an efficient and relatively low-cost way to achieve diversification. But your control on property selection and the timing of returns is delegated to the fund manager.

Investing through a fund may suit an investor who wants a passive investment that delivers diversification and is happy to take a long term approach.

Co-investment vs direct investment: risk and return

Direct investors have the opportunity to outperform the market if they manage to invest their funds in one or a handful of properties that enjoy outsized returns. Of course, they may underperform the market if they invest poorly.

By contrast, co-investment funds that manage a large, diverse portfolio of properties are more likely to experience returns that match the market average or beat it if the manager has the skill to invest across high-growth locations.

That leaves investors facing a familiar trade-off between risk and return. Direct investing offers the possibility of greater control but carries greater risk; co-investing through a fund is likely to mean less control but a higher chance of outperformance.

A new co-investment opportunity for discerning investors

While many investors like residential real estate as an asset class, others believe the negatives outweigh the positives. They’re sceptical of the net returns they might get from co-investing and don’t want to accept the hands-on responsibility of direct investing. So they avoid this asset class altogether, or severely limit their exposure.

Recently, though, a third option has emerged – an innovative property fund that targets attractive capital growth without many of the frustrations of direct investing:

- You don’t have the difficulty of doing hours of research to try to identify high-performing properties

- You don’t have the stress of managing the tenants or maintaining the property

- You don’t have the concentration risk that comes from owning just a small number of investment properties

This new model has been pioneered by HOPE Housing, a not-for-profit fund manager that makes shared-equity property purchases in tandem with essential workers (homeowners). The essential worker makes an equity contribution of at least 50% (via a traditional deposit plus a mortgage) and the provides the balance.

While it may seem like this model solely benefits buyers, it actually delivers a win-win arrangement for investors and essential workers.

Investors

Investors – who must be wholesale or sophisticated investors – invest at least $100,000. Their funds are pooled with those of other investors and spread across a portfolio of properties.

Investors don’t need to manage any of the properties or pay any of the upfront (such as stamp duty or legal costs) or ongoing costs (such as council rates, land tax and insurance), because this is the responsibility of the homeowners.

To ensure the Fund purchases quality properties at a fair price, all investment decisions are put through an investment committee review process and all properties are subjected to pre-purchase independent valuations, building and pest/strata searches and legal review.

As a not-for-profit fund manager, HOPE doesn’t have to deliver a profit to shareholders, so it charges a low management fee of just 0.5% p.a. and doesn’t collect performance fees. At the same time, the HOPE Fund has a claim on the capital growth of the portfolio property asset holdings, which flows back to investors.

Investors benefit in one other important way – they get to make a meaningful contribution to addressing Australia’s housing affordability problem. Given that investors are helping essential workers acquire their own home, rather than buying up more rental properties and thereby diminishing the stock of owner-occupier properties, investors are facilitating greater home ownership.

Essential workers

Essential workers have it tough. Their work is demanding; often stressful; and sometimes traumatic. Many essential workers also have to do shift work, which can be gruelling.

Furthermore, essential workers often earn low-medium fixed salaries. As a result, they may be forced to live on the outskirts of the city despite potentially working close to the CBD. That can mean long commutes, which can affect their physical health, mental health and family life

Sometimes, these first responders, social workers, nurses, cleaners and teachers reach a breaking point: they decide that although they love their job, they need to switch to a higher-paid career so they can afford to buy a home in a more suitable location.

That’s damaging for society, given that we suffer from a shortage of essential workers.

But thanks to HOPE’s shared-equity model, essential workers can enter the market with up to a 50% smaller deposit and mortgage, which makes it much easier to buy a quality property close to their work – and makes it more likely they’ll continue in their chosen career.

Disclaimer

Past performance is not a reliable indicator of future performance. Refer to the Fund Private Placement Memorandum (PPM) for further details which should be reviewed carefully prior to investing.

The information in this article was finalised in June 2024.

The article has been prepared by HOPE Housing Fund Management Limited ACN 629 589 939 (Investment Manager/Manager/Company/HOPE/HOPE Housing) directed to wholesale clients and is strictly for general information and discussion purposes only, without taking into account your personal objectives, financial situation or needs. Before acting on this general information, you must consider its appropriateness having regard to your own objectives, financial situation and needs. The information provided is not intended to replace or serve as a substitute for any accounting, tax or other professional advice, consultation or service and nothing in this article shall be construed as a solicitation to buy or sell any financial product, or to engage in or refrain from engaging in any transaction.

The Investment Manager is a corporate authorised representative (number 001289514) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFS licence number 522145). The authority of the Investment Manager is limited to general advice and deal by arranging services to wholesale clients relating to the HOPE Housing Investment Trust (Fund/HOPE Fund) in Australia only.

The Fund’s Private Placement Memorandum (PPM) dated 19 April 2024 issued by the Specialised Investment and Lending Corporation Ltd ACN 149 520 918 (AFS licence number 407100) (Trustee) which offers investors an opportunity to subscribe for units in the Fund is available. If you would like to receive a copy of the PPM, please email [[email protected]. Prospective investors should carefully consider the contents in the PPM in full and seek professional advice prior to making any decision regarding an investment in the Fund. Past performance and/or forward-looking statements are not a reliable indicator of future performance. Information relating to the Fund contained in this document has been prepared without taking into account the objectives, circumstances, or needs of any person, and may differ to information contained in the PPM. Except as required by law and only to the extent so required, neither the Investment Manager nor its affiliates warrant or guarantee, whether expressly or implicitly, the accuracy, validity, timeliness, merchantability or completeness of any information or data (whether prepared by us or by any third party) within this document for any particular purpose or use or that the information or data will be free from error. Further, the Trustee, the Investment Manager and its affiliates expressly disclaim any responsibility and shall not be liable for any loss, damage, claim, liability, proceeding, cost or expense arising directly or indirectly and whether in tort (including negligence), contract, equity or otherwise out of or in connection with or from the use of the information in this document.