A better way to invest in residential real estate

Enjoy the returns of residential property without the stress of being a landlord by investing alongside owner-occupiers

Strong

returnsii

Access a property growth linked return from a diversified portfolio of vetted Australian residential real estate assets.

Reduced outgoingsiii

Enjoy investing in property without all the usual taxes, letting fees, maintenance and mortgage costs.

Socially responsible

More than property growth, you’re investing in essential workers, so they can own a home close to work.

A new kind of ownership partnership

We co-invest with essential workers to help make home ownership more attainable and affordable. Together we share the investment and the profits.

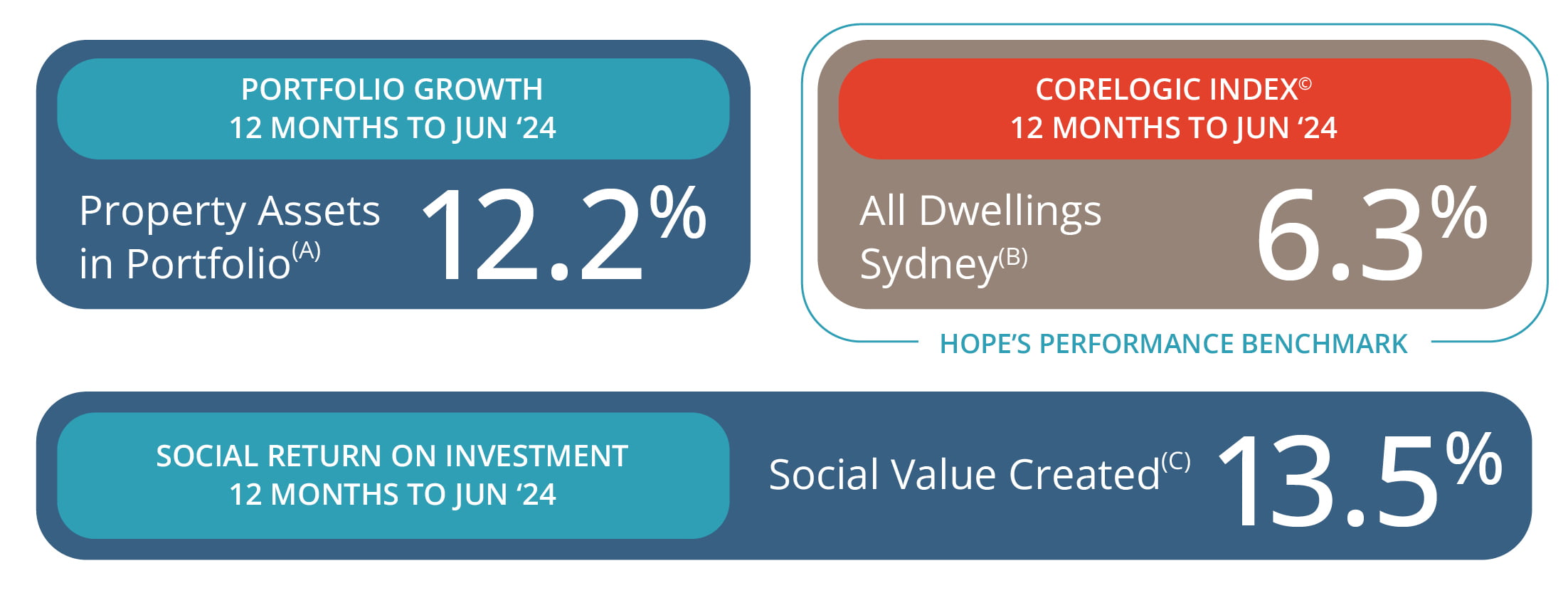

Performance Information

Measurable Impact

HOPE’s social impact is measured using established models and actual homeowner data. Our impact reporting focuses on the effect homeownership has on several critical areas, including:

- Enhancing physical and mental wellbing.

- Reducing commute times and increasing family time.

- Improving workplace productivity.

- Retaining trained esstential workers.

- Making the cost of housing more affordable.

Rated as Investment Grade

“Evergreen’s independent analysis highlights HOPE’s robust asset valuation solution, strategic asset selection process, and the notable social impact it creates”

Angela Ashton

Founder and Director

Evergreen Consultants

Our Investor Partners

Our partners include Super Funds, Family Office Investors and philanthropic organisations. HOPE investors are looking to make a meaningful impact and achieve a measurable social return. Investment in the HOPE Fund aims to deliver a commercial return and solid impact underpinned by Australian real estate assets.

I am a potential investor, keep me updated!

Subscribe to our Investor Newsletter ‘Insights from the Frontline’ using the form below

"*" indicates required fields

AS SEEN ON

Learn more about HOPE's social impact

We’ve improved our impact reporting in collaboration with Think Impact advisors. Quantifying the monetary value of our social impact not only empowers us to make better decisions but also enables us to maximise outcomes for Essential Workers and our communities.

Frequently Asked Questions

Making an investment

1. Who can invest in the HOPE Fund?

The HOPE Fund is open to any investor who meets the Wholesale or Sophisticated investor definition. Our minimum investment is AU$100K.

2. How do I invest?

You can invest directly with the fund via our online application. Soon you will be able to invest via select platforms. For more information on what platforms will be available, contact [email protected].

Financial returns and distributions

3. How are returns generated for investors?

Returns are driven by capital growth exposure to a portfolio of vetted residential property assets. Long term value drivers in the residential property asset class include constrained housing supply, affordability challenges, concentrated urbanisation and a growing population.

4. Is HOPE exposure to underlying capital growth only?

HOPE targets a premium to underlying capital growth through:

- Careful selection of homeowners in collaboration with our banking partners;

- Vetted property selection, with requirements around location, asset type and condition; and

- Capped purchase prices for all assets added to the fund.

5. How is liquidity generated in the Fund?

The below two mechanisms may generate liquidity for the Fund:

- Property sales by homeowners – the average hold period for a property in the Sydney market is 5.5 years (insert this link: https://hopehousing.com.au/investor-hub/residential-property-investing/exploring-the-liquidity-characteristics-of-the-residential-property-market/)

- Progressive Equity Buy Outs by homeowners – homeowners increase their equity stake annually, with the equity price determined by the market-value of the property at the time of the transaction.

6. Will I receive any rental income?

No. However, subject to liquidity from property sales and Equity Buy Outs, the HOPE Fund aims to distribute cash quarterly to investors.

7. Does the HOPE Fund cover typical Landlord costs like rates, utilities, strata fees and property insurances?

No – the Fund pays none of these typical fees, as the homeowner is responsible for all costs related to the property. The homeowner is also on title and no land tax is payable by investors in the HOPE Fund.

8. Can I sell my units?

Unit holders may be able to transfer their units to third parties, subject to terms outlined in the PPM.

9. What properties will be eligible: strata units, freehold dwellings, new builds, old builds?

HOPE may provide capital for all types of housing except for off the plan developments. All approvals are subject to HOPE’s full pre-purchase due diligence conducted on every asset, this includes an onsite valuation, which sets the purchase price limit for our co-investment.

Social returns

10. How does the HOPE Fund measure its social impact return?

HOPE has developed a social return methodology in partnership with industry experts, including The Centre for Social Impact and Think Impact. In the 12 months to December 2023 the Fund delivered a social return of 13.5% p.a.

DISCLAIMER

The offer of units in the HOPE Housing Investment Trust (Fund) is available only to ‘wholesale clients’ within the meaning of that term under the Corporations Act 2001 (Cth). This page does not constitute an offer for units in the Fund. Prospective investors should refer to the Fund’s private placement memorandum for further information about the offer and the Fund. Past performance is not a reliable indicator of future performance. For more information about the Fund, please refer to our Investor Disclaimer on our website.

(i) HOPE refers to HOPE Housing Fund Management Limited.

(ii) HOPE offers an investment opportunity for sophisticated investors to access the Australian residential real estate market which has had 40+ years of historical growth rate of 7.89% according to BIS Oxford Economic property index. The HOPE Fund’s return may not correlate to the historical returns of the Australian residential real estate market.

(iii) An investment in HOPE Fund gets you access to a diversified portfolio of residential real estate. Homeowners are on title and required to maintain the home and all pay costs. HOPE has priority on all properties within the portfolio.

(A) Portfolio growth is determined by estimating market value of the properties within the Fund’s portfolio monthly, using CoreLogic IntelliVal (Automated Valuation Estimate) and PropTrack AVM. The change in total portfolio value is indexed from a base value of 100, established at the inception of the Fund’s portfolio, to account for the addition of new properties during the same period. The 12-month growth represents the cumulative growth over the prior four quarters. The portfolio growth information does not take into account liabilities or expenses of the Fund and therefore may not reflect overall Fund performance.

(B) This is the growth of residential real estate in the Sydney market and is sourced from the ‘CoreLogic Hedonic Home Index reports’ for ‘All Dwellings’ in the Sydney market. The detailed methodology can be found on the CoreLogic Australia website.

© Copyright 2024. RP Data Pty Ltd trading as CoreLogic Asia Pacific (CoreLogic) and its licensors are the sole and exclusive owners of all rights, title and interest (including intellectual property rights) subsisting in this publication, including any data, analytics, statistics and other information contained in this publication (Data) . All rights reserved.

(C) Social return on investment is determined by HOPE and is assessed by surveying HOPE homeowners and applying proxies, sourced from domestic and international academic studies, to calculate value creation using a methodology that adheres to Social Value International’s principles of social valuation. ‘The Principles of Social Value’ and the methodology is available on Social Value International’s website. Social return is measured annually by HOPE each December. For more information about the calculation of the social return, please contact HOPE.

~Evergreen Rating: ©Evergreen 2023. All Rights Reserved. (ABN 91 643 905 257) (‘Evergreen Ratings’) is Authorised Representative 001283552 of Evergreen Fund Managers Pty Ltd trading as Evergreen Consultants (ABN 75 602 703 202, AFSL 486275). The group of companies is known as ‘Evergreen’. Evergreen is authorised to provide general advice to wholesale clients only. Any advice provided is general advice only and does not consider the objectives, financial situation or particular needs of any particular person. It is not a recommendation to purchase, redeem or sell any particular product. Before making an investment decision the reader must read the relevant product offer document, consider their own financial circumstances or seek personal financial advice on its appropriateness for them.