A new co-investment scheme, backed by family offices and institutional investors, will be made available to first responders and frontline workers,helping them secure a property close to their workplace.

Jamie Williamson

Launched today, the Home Owners’ Partnering Equity (HOPE) initiative will co-invest up to 50% of an existing home’s purchase price for essential workers. Itis underpinned by a social impact investing model that is backed and measured by The Centre for Social Impact at UNSW using its new Amplify Online tool.

The initiative is offered in partnership with Police Bank as the exclusive mortgage provider and requires a minimum 2.5% deposit. The house purchased mustbe the essential worker’s primary residence.

Investment interest has proved strong already, HOPE said, adding that it’s on the way to raising about $400 million for the fund from a range of family offices,impact investors and institutions.

Under the scheme, the essential worker is named as the owner on the Title and is free to decide when to buy and when to sell. They pay no administrationfees or charges to the HOPE Fund and can pay down HOPE’s equity share at any time. Upon selling, any capital gains will be split proportionally according toequity interest – same goes for any losses.

In developing the model, HOPE said it engaged with various unions and industry bodies for essential workers and found it is sought after and in need ofdeployment.

“HOPE has been designed to overcome the challenge of essential workers being priced out of the local suburbs in which they work. Our homeownershipsolution is designed to ensure our essential workforce can live near their work and, in doing so, help strengthen our communities,” HOPE chief executive TimBuskens said.

Also commenting, Police Bank chief executive Greg McKenna said the partnership makes sense given the bank was established almost 60 years ago to helpessential workers gain financial wellbeing for themselves and their families.

“This partnership with HOPE, built on an alignment of value and purpose, enables us to continue this mission while unlocking capital to address the biggestissue facing our customers,” he said.

“Australia has high obstacles to home ownership, and we believe financial institutions owe it to their customers to find solutions – as a member-owned bankthis is exactly what we are here to do.”

The program is initially only available to workers in New South Wales, the government of which recently announced its own shared equity scheme. However,HOPE’s scheme doesn’t apply any caps on income or purchase price like the government’s does and is available to all essential workers – no matter their ageor personal situation; the NSW government scheme is only available to essential workers where they are buying for the first time.

HOPE has plans to expand the initiative to other capital cities as other investors come on board and more funds are raised.

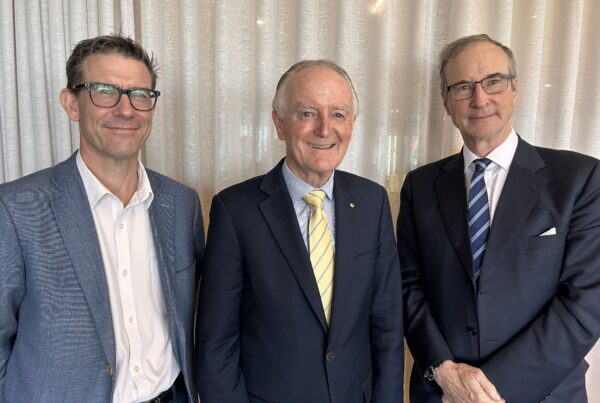

HOPE, which has been working to get the scheme off the ground for the past four years, was founded by Pacific Equity Partners managing director and co-founder Tim Sims, who has personally funded HOPE until now.

It is supported by an advisory board that includes Pendal Australia chief executive Richard Brandweiner, former First State Super chief executive MichaelDwyer and TCorp head of investment stewardship Alexis Cheang.

Article originally published on www.financialstandard.com.au – Monday 4th July 2022.