Ensuring our members can afford a home within the communities they serve is one of The PANSW’s top priorities.

Angus Skinner

PANSW Research Manager

Government action to date has been limited to small-scale rental options

that do not suit police officers’ needs or advance their financial security long-term.

Your Association wants you and your colleagues to be able to purchase, not rent, a comfortable home suitable for you and your family in a location where you can travel to work without exacerbating fatigue and be connected to the community you serve if that is where you want to live.

The gold-plated solution is a shared equity program prioritising key worker access to buying their own home.

Shared equity programs are where a potential homeowner and an ‘equity partner’ share the capital cost of purchasing a home. The homeowner then lives in the home and can buy a larger share of the equity as their ability to do so grows. When they eventually sell the property, they and the equity partner split the sale proceeds according to the equity share percentage they each hold.

This benefits all parties: the potential homeowner can purchase a home that would otherwise have been outside their price range. They get their foot in the property market and benefit from any property value increase (according to their percentage share of the equity).

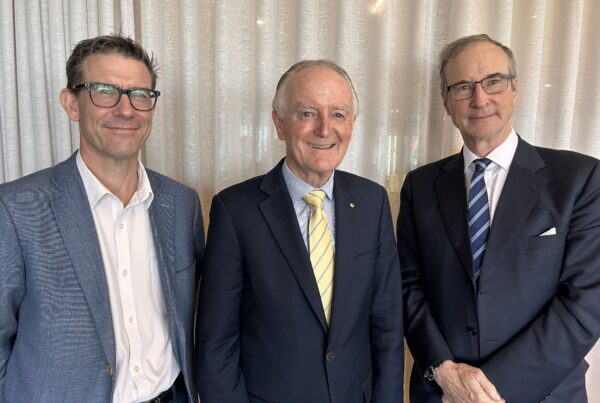

To make this a reality, the PANSW has worked with its valued partner Police Bank and HOPE Housing and is pleased to announce this partnership will deliver a shared equity program. Police Bank Chair Peter Remfrey shares this exciting news and what it means for members.

Peter Remfrey

Chair – Police Bank

Are you sick of a long commute to work? Are you finding it challenging to buy a home close to your workplace?

If you’re like many members I’ve spoken to over the years – especially as property prices skyrocketed in capital cities and across Australia – you most likely answered yes to both questions.

I’m pleased to share with you that Police Bank, working with its partner HOPE Housing, is trialling a solution to make home ownership more affordable and accessible for Police and other essential workers.

This sits at the heart of who we are – a bank focused exclusively on being the best financial partners of our members, the police family. We are here to help them create the financial outcomes they want, however we can.

Police Bank is a mutual financial institution owned by members for members. Established in the 1960s by police working in the then Number 1 Division, we exist to provide the police family with financial security while supporting critical organisations like Police Legacy and sponsoring a wide range of police sporting and social events. The Bank focuses on home loans for members. With HOPE, we have developed an innovative solution to the issue of housing affordability.

In recent years, police and other emergency services have been a never-ending cycle of responses to crises – fires, the ongoing COVID-19 pandemic, and floods. With no option to work from home, police have been at the coalface, keeping our communities safe 24/7 and placing themselves (and their own families) at risk.

Despite the economic difficulties, the one thing that Covid and natural disas- ters did not stop was the relentless boom in the housing market. Sydney is now the second most expensive city in the world for cost of living and property prices, according to this year’s Demographia International Housing Affordability Survey. As a result, police and other essential workers have been pushed to live in the outer suburbs of our communities, unable to crack into the housing market. In cities like Sydney especially, rising prices pushed the Australian dream further out of reach for most.

What does this mean? Long commutes – greater than 90 minutes – have become the norm for most police, which is less than ideal when you’re a shift worker and work long and unsocial hours with few public transport options. In addition, limited time with family and not being a part of the community are now unfortunate realities for our members.

The Bank and Your Association have been wrestling with ideas to solve this problem. We have worked for over two years with not-for-profit organisation HOPE Housing, whose mission is to “deliver home ownership help to everyday heroes.” They believe wholesale investors can contribute to and benefit from providing a solution to the housing affordability problem in Australia by creating a shared equity partnership with essential workers. This model will allow police and other essential workers to purchase a home and contribute a minimum of 50% of the cost of the home with HOPE investors meeting the remainder.

For example, a member could purchase a $2M home, paying a 2.5% deposit with the remainder of the $1m secured through a home loan with Police Bank. HOPE would then contribute the other 50% with a $1m contribution. The HOPE capital means the member requires less of a deposit and has less of a mortgage. This will allow more members to achieve home ownership and purchase homes closer to where they work or for any other lifestyle reason, including being closer to family, schools for the children, or living near a beach! Significantly, it also reduces mortgage stress at a time of rising interest rates.

Officers will own their homes and the HOPE investors will only receive their share, including the proportional share of any capital gain, when the member decides to sell their property. Members can sell their homes anytime or choose to continue living there into retirement. There are no additional costs for the member than for a normal home loan. The homeowner can also pay the HOPE share down anytime. Naturally, some conditions apply to these loans, and members will be required to get independent legal advice before proceeding with a HOPE loan.

The Police Bank HOPE shared equity model is not limited by the property’s price or the owners’ income, as is the case with schemes recently announced by the NSW and Commonwealth Governments. With no caps on income or home prices, HOPE will be able to help those who don’t meet the eligibility criteria of these government schemes. Initially, the product will only be available in the Sydney metropolitan area, but there is scope for it to be expanded more broadly.

Investors in the HOPE scheme are involved for two reasons. They will achieve a return over time with their share of capital gains but are also motivated to invest as a social good by assisting police and other essential workers to live and contribute to their communities. It’s a form of social impact investing, where investments are made with the intention of generating a measurable, beneficial social or environmental impact alongside a financial return.

Police Bank has commenced a limited pilot of the scheme. It is anticipated that once this is reviewed, we will be able to offer the product to any member of the Bank who fits the criteria. It may not be a product for everyone. Still, I think it will be a game changer for police in terms of providing options for home ownership into the future.

For more information, please contact our specially trained and accredited Police Bank lenders at loans@policebank. com.au. They can identify and assess applicants that will benefit most with a helping hand from HOPE.

Article originally published in the Police Association monthly newsletter – Sept/Oct 2022